CFDS

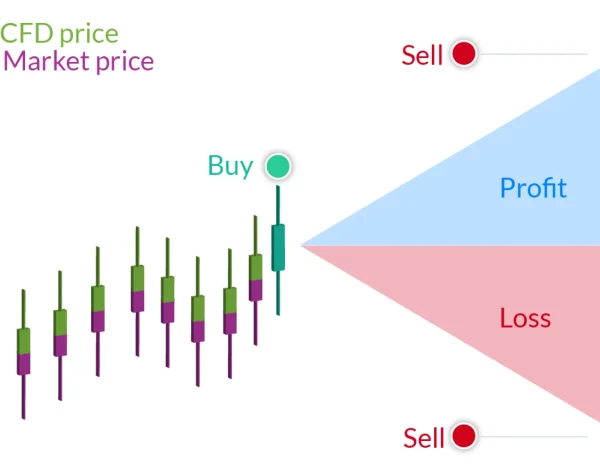

Commodity CFDs are contracts that mirror the performance of the underlying commodity with the futures prices calculated as the difference between the purchase price and the selling price, hence the term contract for difference.

Market trading hours are an important factor when trading CFDs. If you have an open position when the markets close, this means you will not be able to close your trade until the market re-opens again the next trading day. Just like many of the traded markets, volatility is also present in the commodity markets. This means that the opening price at the start of the next trading session can be vastly different from the closing price in the previous trading session and as a result you can see large swings in profit and loss. Please see contract specifications for more details.